Introduction

The US Dollar Index (USDX), often referred to as DXY, is a widely recognized measure of the value of the United States dollar against a basket of other major currencies. It plays a significant role in global financial markets, influencing trade, investments, and economic policies. In this article, we will delve into the details of the US Dollar Index, its calculation methodology, factors affecting its value, and its implications for the global economy.

Body:

I. What Is The US Dollar Index?

The US Dollar Index is a measure of the value of the US dollar relative to a basket of six major currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc. It was introduced in 1973 by the Intercontinental Exchange (ICE) to provide a benchmark for the performance of the US dollar in international markets.

II. Calculation Methodology

The US Dollar Index is calculated using a geometric weighted average formula that assigns different weights to each currency in the basket. The euro holds the largest weight, followed by the yen, pound, Canadian dollar, krona, and franc. The index is based on exchange rates, with the US dollar assigned a value of 100 at the index’s inception. Changes in the index reflect the strength or weakness of the US dollar against the basket of currencies.

III. Factors Affecting The US Dollar Index

Several factors influence the US Dollar Index, leading to fluctuations in its value:

- Macroeconomic Indicators: Economic data such as GDP growth, inflation rates, employment figures, and interest rates affect the US Dollar Index. Strong economic performance usually leads to an appreciation of the US dollar, while weak economic indicators can result in its depreciation.

- Monetary Policy: Decisions made by the Federal Reserve, the central bank of the United States, have a significant impact on the US Dollar Index. Actions such as interest rate changes, quantitative easing, or tightening policies can influence the value of the dollar.

- Political Stability: Geopolitical events, elections, and policy changes can affect the perception of the US dollar as a safe-haven currency. Political instability or uncertainty may lead to increased demand for the dollar, boosting its value.

- Global Trade and Capital Flows: Trade imbalances, international capital flows, and geopolitical tensions impact the US Dollar Index. Changes in global trade patterns and capital movements can influence currency exchange rates, indirectly affecting the index.

IV. Implications For The Global Economy

The US Dollar Index has far-reaching implications for the global economy:

- International Trade: As the world’s primary reserve currency, fluctuations in the US Dollar Index can impact the competitiveness of exports and imports. A strong dollar makes imports cheaper and exports more expensive, potentially affecting trade balances and economic growth.

- Investment Decisions: Investors and fund managers often use the US Dollar Index as a benchmark to assess the performance of their portfolios. It influences investment decisions in various asset classes, including stocks, bonds, commodities, and currencies.

- Emerging Markets: Changes in the US Dollar Index can significantly impact emerging market economies. A stronger dollar may lead to capital outflows from these countries, causing currency depreciations, higher borrowing costs, and potential financial instability.

- Global Monetary Policy Coordination: Central banks around the world monitor the US Dollar Index to guide their monetary policies. Exchange rate fluctuations can influence their decisions on interest rates, exchange rate interventions, and foreign exchange reserves management.

Conclusion

The US Dollar Index plays a vital role in global financial markets, reflecting the value of the US dollar against a basket of major currencies. Its fluctuations impact trade, investments, and global economic stability. Understanding the factors influencing the index can help businesses, investors, and policymakers make informed decisions. The US Dollar Index will continue to be closely monitored, as its movements have far-reaching consequences for the global economy.

FAQs:

- How often is the US Dollar Index updated? The US Dollar Index is updated in real-time, reflecting the constantly changing exchange rates between the US dollar and the currencies in its basket. It is available for monitoring 24 hours a day, five days a week.

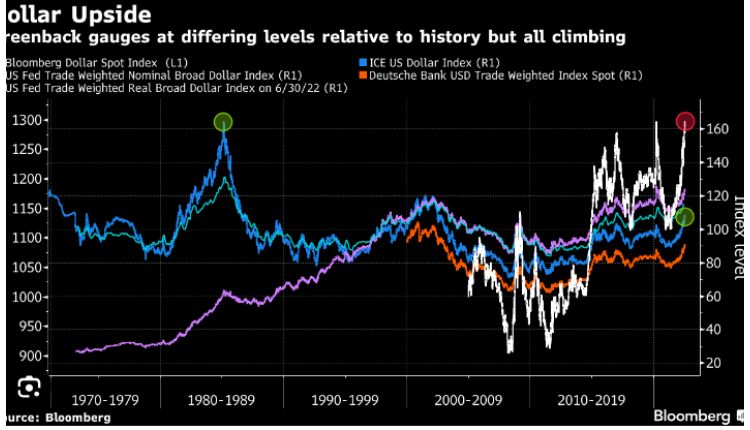

- Is the US Dollar Index the only measure of the dollar’s value? No, the US Dollar Index is one of several measures used to assess the dollar’s value. Other popular indices include the Trade Weighted U.S. Dollar Index, which incorporates a broader range of currencies, and bilateral exchange rates against specific currencies, such as the USD/EUR or USD/JPY exchange rates. These different measures provide a more comprehensive view of the dollar’s performance in various contexts.