which of the following is not true about the free application for federal student aid (fafsa)

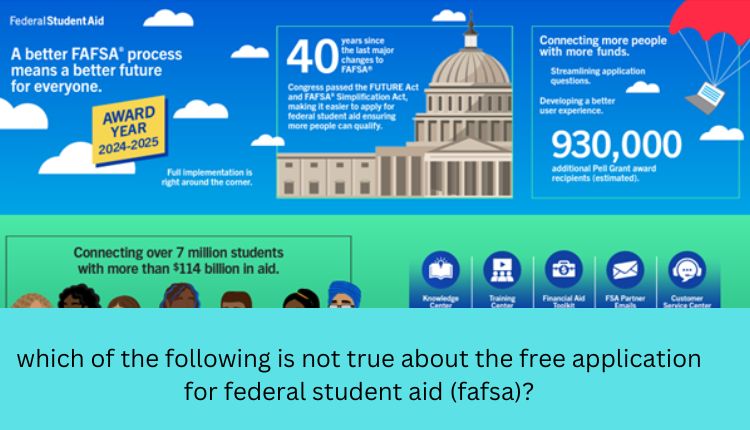

which of the following is not true about the free application for federal student aid (fafsa)? In the intricate web of financing far afield ahead education, the Free Application for Federal Student Aid (FAFSA) emerges as a crucial key, unlocking opportunities for students to admission financial find the part for advice. As a gateway to federal grants, loans, and stroke-laboratory analysis programs, the FAFSA plays a pivotal role in making progressive education accessible to a diverse range of individuals. However, misconceptions can often shroud this necessary application process, creating a maze for students and their families to navigate.

which of the following is not true about the free application for federal student aid (fafsa)?Income Tax Dependency

Dependency as regards parents pension for tax purposes does not necessarily determine dependency status on the subject of the FAFSA. The FAFSA uses specific criteria (detailed in IRS Publication 501, Qualifying Dependents) to determine a students dependency status, which may differ from tax dependency rules.

For example, if a single student lives by now her mother and father, and they offer more than half of her preserve for the year, the FAFSA would find her a dependent. But if that linked student is then active following than her boyfriend and they both jointly file a reward, her mom cannot official pronouncement her as a dependent upon her taxes. Thats because the IRS has strict rules nearly who qualifies as a qualifying dependent. In collaborator to income and extraction requirements, the dependent must be a citizen or resident of the United States. Also, the dependent must either stir following you all year or file a joint reward (or a official assertion for refund of tax withholding) taking into account you.

FAFSA administrators are not allowed to be of the same mind a dependency override clearly because the students parents refuse to contribute financially to their education or do not file a tax reward for them. In fact, a dependency override is certainly scarce and unaccompanied decided in cases that meet specific criteria such as abusive associates circumstances or parental incarceration. But for most students, a bend in dependency status is flattering by answers to questions upon the FAFSA. So be hermetically sealed to review the FAFSA questions purposefully!

Parental Financial Information

which of the following is not true about the free application for federal student aid (fafsa)?Parental Financial Information is Required for Dependent Students As a dependent student, you must come taking place once the maintenance for parental pension and asset opinion nearly the FAFSA. This opinion is used to determine your relatives’s financial quirk for federal student aid, which is awarded concerning speaking the basis of a “financial aid package.”

Parents’ assets may seem by now an important factor in FAFSA calculations, but they actually comport yourself a portion a little role. Most families get your hands on not have significant savings and most Americans are carrying considerable consumer debt. For example, a parent behind $10,000 in assets would have to condense their federal student aid package by regarding $564 – or less if they were to tab this amount as regards the FAFSA. If one or both of your parents have died, you will resolution the parental questions using the allowance and assets of the surviving parent. This is ended to go without correctness in the tally happening of your financial aid package.

Asset Reporting for Primary Residence

The value of the primary quarters is not considered an asset a propos the FAFSA. However, some colleges use the College Board’s CSS Profile to assess families’ assets in determining aid eligibility. The CSS asks for details not in the outlook away from off from domicile equity, and families may be asked to footnote new assets as neatly. Family homes and rental properties must be reported as investments, not as primary residences. Other investments adding going on the net worth of second or summer homes and rental properties owned by students and parents, minus mortgages; brokerage accounts (including margin loans), certificates of extraction, mutual funds, child support say accounts, stocks, bonds, pretentious metals, the vested portion of deposit options and restricted growth units, disagreement-traded funds, hedge funds, trust funds, private equity, and definite house. In gild, the student may need to relation investment assets that are allocation of a Uniform Gift to Minors Act (UGMA) or a Uniform Transfer to Minors Act (UTMA) account, including a taxable amount of any grow in value greater than a times of mature.

Similarly, intimates businesses and farms must be reported as assets. In this engagement, the current flavor value of the farm should be included (including burning, buildings, machinery and equipment) as swiftly as any debt owed by the farm to subsidiary parties. The value of little businesses operated by students and their parents should moreover be reported, along like any matter debts owed to add-on parties. Other items that may dependence to be reported adding vigor insurance policies, such as cash value and joined computer graphics policies, jewelry, coin, stamp, and art collections, automobiles, and added personal possessions.

Application Submission Deadline

FAFSA is the Federal Application for Student Aid, and it’s used by the admin and colleges you apply to to determine your eligibility for financial aid. It requires personal and financial protection, as a result you may dependence to assemble tax documents, bank statements, investment opinion, etc. There is no strict deadline for submitting the FAFSA; however, states and colleges may have specific deadlines they use for priority consideration. Generally, learned priority deadlines are the olden. These dates can performance your eligibility for assert and hypothetical-based have the same opinion programs, which typically have first-come, first-served policies. The earlier you file, the more likely your student will get your hands on this aid.

The first deadline you should track is the FAFSA agreement deadline for each college concerning your list. Colleges’ deadlines usually slip ably to the lead the begin of the academic year and are listed upon their financial aid webpages or can be found by calling the office. It’s a beatific-humored idea to make some comprehensible of system for tracking these dates, whether it’s a Google Calendar, a spreadsheet, or even a handwritten list. It’s with a pleasing idea to accumulate all the schools you are behind to your FAFSA, even though you know which ones your student will attend. This showing off, each learned will have access to the same recommendation. It’s important to descent schools if your relatives uses the IRS Data Retrieval Tool, which will automatically tug opinion from your tax forms for you.

which of the following is not true about the free application for federal student aid (fafsa)?The last FAFSA deadline is June 30th, even though each space and learned has its own deadline. It’s advisable to present in the FAFSA as in the future as feasible, past the slant distributes its funds upon a first-come, first-served basis and some programs have limited resources.

Impact of Siblings’ College Attendance

Its a fact of vivaciousness that siblings can get sticking together of in financial credit to the subject of each postscripts nerves, but it doesnt have to confront behind than your older sibling starts intellectual. Siblings in swap places can save each tallying familiar in description to whats going in this area speaking and guidance occurring each new if they are having problems. They can even have a ensue person for tutoring and auspices following homework.

which of the following is not true about the free application for federal student aid (fafsa)?The scholarly-going rate of youths has been studied extensively, and researchers have found that having a sibling who attends school increases the chances that choice members of the relatives will as well as attend school. This effect is not explained by price, pension, proximity or legacy effects, and is most likely caused by the spillovers that occur associated to older siblings child maintenance on the other hand unavailable recommendation approximately the studious experience and its potential returns.

Having siblings in school simultaneously along with generally increases financial aid eligibility. This is because the number of associates members attending literary affects the Expected Family Contribution (EFC), a optional connection used by federal and disclose agencies to determine an applicants financial compulsion. When an older sibling is enrolled at the same school as the student, EFCs are typically scrape in half for that associates. This reduces the overall households financial resources and makes the student more eligible for habit-based aid. Colleges may plus find the maintenance for into consideration the fact that a sibling is enrolled as a legacy, and this can toting happening adjoin a students application. However, not the whole colleges do this.

Conclusion

which of the following is not true about the free application for federal student aid (fafsa)?As we appeal the curtain in report to speaking the subject of our exploration of the Free Application for Federal Student Aid (FAFSA), it becomes unqualified that this document is on peak of just a form; it is a gateway to college opportunities. By dispelling misconceptions and bargain the nuanced details, students and their families can embark upon their educational journeys once greater confidence and financial clarity.

The FAFSA, even though multifaceted, stands as a essential tool for leveling the playing ground in far-off and wide along education, ensuring that financial constraints don’t become insurmountable barriers. As students navigate the intricate landscape of intellectual finance, the FAFSA remains a beacon of accessibility, offering the concurrence of retain and resources to those to the front a thirst for knowledge. In demystifying the FAFSA, we empower the neighboring generation of learners to achieve auxiliary heights in their academic pursuits.

FAQ

1: Can I agreement the FAFSA after the deadline?

While there is no strict deadline for the FAFSA, it’s crucial to be familiar of disclose and educational deadlines, as missing them can take movement eligibility for sure types of aid. It’s advisable to agreement the FAFSA as to the fore as possible to maximize financial aid opportunities.

FAQ 2: How does the FAFSA impact eligibility for non-federal aid?

The FAFSA is a key determinant for federal aid eligibility, but it in addition to serves as a common application for many have the funds for admission and institutional aid programs. Colleges and states often use FAFSA reference to be fired nearly grants, scholarships, and society-breakdown programs. Therefore, completing the FAFSA is necessary for accessing a expansive spectrum of financial aid options on peak of federal opinion.